In an analysis shared on X, cryptoanalyst Patric H. of CryptelligenceX outlines seven reasons why investors should be bullish on the Bitcoin price trajectory this week. “How can anyone be bearish here?! BTC broke the weekly downtrend and closed above key levels and some people are still demanding sub $40k?! Sorry bears, you clearly missed the fundamental changes of the past two weeks,” states he.

#1 Mt. Gox Bitcoin Refund Deadline Extension

The defunct stock exchange Mt. Gox has requested a change to its repayment deadline, which has been approved by the court. The new deadline for reimbursing the remaining creditors is now set for 31 October 2025, a full year later than the previously planned October 2024. This extension removes the immediate selling pressure on the market of approx. flood the market.

#2 China’s economic stimulus

China is set to issue $325 billion in bonds to stimulate its economy. In parallel, crypto exchange OKX has launched a fully licensed trading platform in the United Arab Emirates (UAE), offering a legal opportunity for Chinese investors to engage in cryptocurrency trading under UAE jurisdiction. Patric H. predicts, “Chinese money will enter crypto in Q4.” #3 Declining Bitcoin Exchange Reserves

Bitcoin exchange reserves continue to fall as institutional investors and whales accumulate the cryptocurrency at unprecedented rates. This trend indicates a supply shortage on exchanges, which together with rising demand could lead to a supply shock. “Ultimately, this will cause a supply shock, leading to higher prices in good time,” notes the analyst. #4 rise in Bitcoin whale accumulation

On-chain data reveals that new Bitcoin whales are accumulating assets like never before. Ki Young Ju, CEO and founder of CryptoQuant, recently commented: “The current market volatility is just a game in the futures market. Real whales are moving the market through spot trading and OTC markets. That’s why on-chain data is crucial.”

He added that these new whales are unlikely to sell until significant liquidity from retail investors enters the market. “See How Fiercely the New Whales Are Stacking Bitcoin; this market has never seen such accumulation,” he stressed. In particular, the lack of correlation with US spot ETF inflows suggests that these could be strategic institutional accumulations.

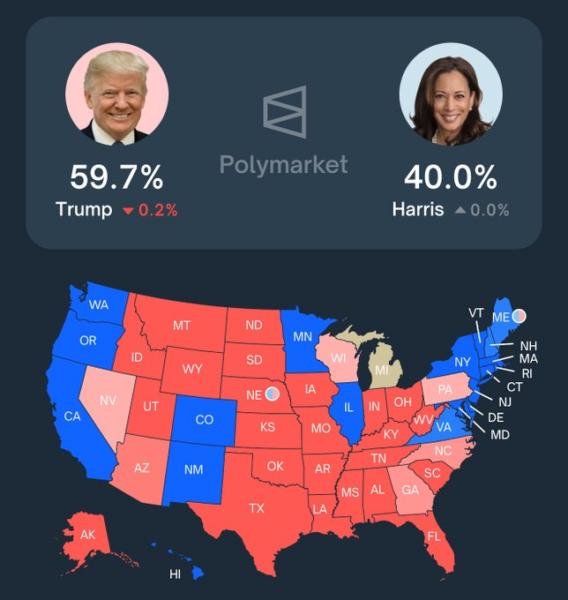

#5 Trump leads the polls

Political forecasts suggest that former US President Donald Trump is gaining favor in swing states ahead of the upcoming election. According to Polymarket’s latest data, Trump is expected to win all seven key swing states. Patric H. reminds readers, “Trump is pro-crypto; Elon Musk wants to lead a Department of Government Efficiency (DOGE).

#6 S&P 500 as trailblazer

The S&P 500 index is trading at an all-time high, historically signaling positive momentum for Bitcoin and crypto. “There hasn’t been a time in history when Bitcoin and the altcoins market didn’t catch up with the performance of the S&P 500,” Patric H. points out, dismissing skepticism with, “But ‘this time is different’… yes, of course .” The correlation between traditional markets and cryptocurrencies suggests that bullish trends in stocks may spill over into the Bitcoin and crypto sectors. #7 Seasonal

Historically, the fourth quarter (Q4) has been the most bullish period for Bitcoin, especially in halving years. “Bitcoin and the crypto market tend to outperform all asset classes in half a year,” argues the analyst.

Supporting these fundamentals, technical analysis also paints a positive picture for Bitcoin. Patric H. highlights that Bitcoin has closed above its weekly downtrend line, signaling a potential reversal from bearish to bullish momentum. Furthermore, the cryptocurrency is holding solidly above the 50-week exponential moving average (EMA), a critical support level. Furthermore, the Moving Average Convergence Divergence (MACD) indicator has made a bullish cross for the first time since April, often interpreted as a buy signal.

“Yes, there will be withdrawals every now and then. But from now on, dips are for buying, as the market structure clearly changed from a downtrend to an uptrend,” concludes Patric.

At press time, BTC was trading at $68,397.