Bitcoin speculators have initiated mass profit-taking as BTC price gains take the market to three-month highs.

Data from onchain analytics platform Glassnode shows Bitcoin BTCUSD short-term holders (STHs) cashing in on the price increase above $65,000.

Bitcoin short-term holders eye profit protection

Bitcoin investors relatively new to the market — entities that hold a given amount of BTC for 155 days or less — are busy sealing profits at current levels.

Glassnode shows that on October 14, the amount of BTC sent by STH wallets to the largest global exchange, Binance, was the largest since BTCUSD set all-time highs of $73,800 in March.

In total, Binance saw STH inflows of 7,127 BTC (approx. $480 million).

Taking into account all major exchanges tracked by Glassnode, the daily numbers this week are among the highest since early June.

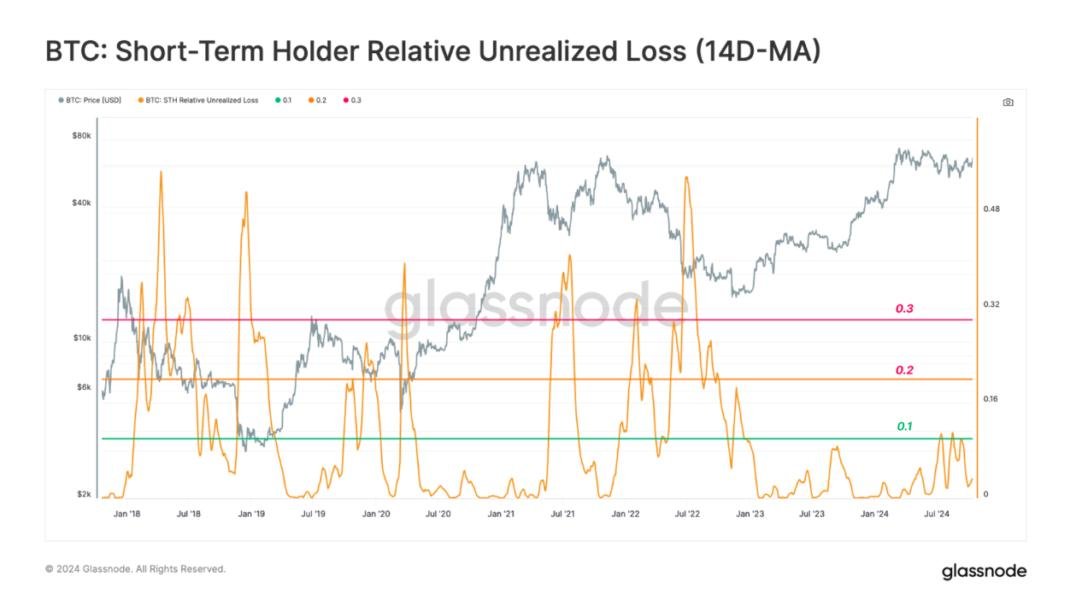

Analyzing STH’s financial buoyancy, the firm highlighted the healthy profit margins that currently provide a sense of achievement after months of sideways price performance.

“Short holders are currently showing profit dominance with their Profit/Loss Ratio trading at 1.2,” said a post on X.

“This metric recently broke 1 standard deviation above its 90-day moving average, signaling a potential positive shift in investor sentiment.”

BTC Price Survey Sees “Increased Volatility”

As Cointelegraph reported, Bitcoin investor sentiment remains volatile this month. Relatively modest volatility has resulted in dramatic shifts in market exposure.

Meanwhile, the largest class of Bitcoin whales has amassed 1.5 million BTC in recent months.

Continuing, Glassnode noted that while demand for BTC has largely declined since March’s highs, so has supply availability.

“A notable divergence between supply and demand forces continues to grow,” it concluded in the latest edition of its weekly newsletter, “The Week Onchain,” published Oct. 15.

“The demand side of the market has declined significantly since the March ATH, while several measures of ‘active supply’ continue to compress and narrow. In terms of historical precedence, previous examples of acute tightness across the Bitcoin supply side have been a precursor to a regime of increased volatility.”

Among the accompanying charts was confirmation of STH’s low unrealized losses.

This article does not contain investment advice or recommendations. Any investment and trading move involves risk and readers should do their own research when making a decision.