- Bitcoin showed signs of recovery as its weekly and daily charts were green.

- Market indicators and metrics suggested a price correction.

Bitcoin [BTC] has faced back-to-back price corrections over the past few weeks, causing problems for its rally. The last week was somewhat in investors’ favor as the royal coin saw price increases.

However, a new report has suggested that BTC may once again fall victim to a correction.

Bitcoin rally faces trouble

The Bitcoin rally has been facing problems of late as it has struggled to get above $66k. However, the last 24 hours showed better signs. As per CoinMarketCapincreased the coin’s price by more than 1.5%. At press time, Bitcoin was trading at $63,896.05.

The recent price increase has pushed 48.9 million BTC addresses into surplus, which accounted for for 91% of the total number of BTC addresses. But BTC’s troubles are not over yet as there were chances of the Bitcoin rally coming to an end.

Ali, a popular cryptanalyst, posted one tweet reveals an interesting development. According to the tweet, BTC’s price was moving inside a channel.

The bad news was that the coin had already been rejected three times as it approached the resistance of the pattern. Therefore, it indicated that this recently gained bullish momentum may not last. So AMBCrypto planned to dig deeper.

What’s next for BTC?

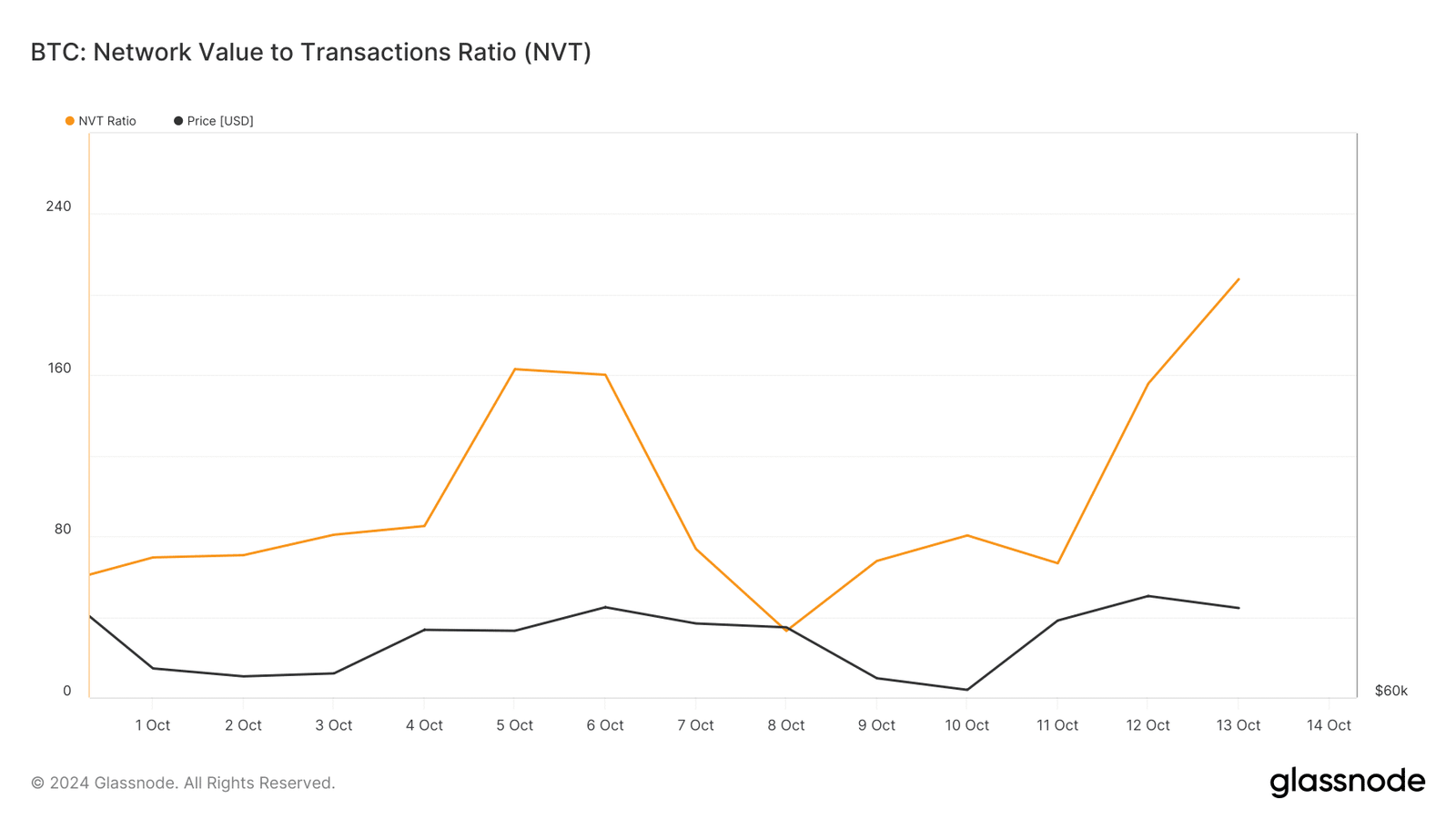

According to our analysis of Glassnode’s data, one metric suggested a halt to the Bitcoin rally. We found that the king coin’s NVT ratio increased. Whenever the metric rises, it indicates that an asset is overvalued, suggesting a price correction.

Source: Glass node

We also found that the coin’s long/short ratio decreased. This meant that there were more short positions in the market than long positions. An increase in the number of short positions can be interpreted as a bearish signal.

However, everything was not in the bears’ favor. For example, according to CryptoQuant, BTC’s currency reserve decreased. A decrease in this metric means that buying pressure was increasing, which often results in price increases.

Source: CryptoQuant

To better understand what to expect from the bitcoin rally, AMBCrypto checked the coin’s daily chart. The technical indicators looked quite bearish. BTC’s MACD showed a bearish advantage in the market.

Read Bitcoins [BTC] Price prediction 2024-25

Additionally, the coin’s Chaikin Money Flow (CMF) also recorded a drop, suggesting a price drop. If that happens, the Bitcoin rally could end and the coin could fall back to $60k.

Nevertheless, in the event of a continued price rise, BTC may test its resistance at $65.4k again.

Source: TradingView