- ETH saw more inflows to exchanges in the last trading session.

- The ETH balance on exchange has continued to decrease.

A recent analysis of Ethereum’s [ETH] market activity revealed a pattern of accumulation and sell-off from various addresses over the past few days.

Despite these mixed trends, the total volume of ETH on exchanges has decreased, which is often a bullish signal.

Ethereum is seeing mixed signals

Recent activity in the Ethereum market has produced mixed signals from key indicators. On the one hand, there has been notable accumulation of some large holders, or “whales,” which is typically a bullish sign.

Analysis of the holders’ data shows that these whale addresses have increased their holdings by approximately 200,000 ETH, equivalent to about $540 million.

On the other hand, some institutional players have sold, which could indicate a more cautious or bearish outlook from certain market participants.

Data from Lookonchain revealed that institutions such as Amber Group and Cumberland have sold over 13,000 ETH, worth more than $35 million, in the last 24 hours.

This institutional selling pressure contrasted with the whales’ rally, creating a mixed market sentiment.

While the whale accumulation points to strong faith in Ethereum’s future, the institutional sell-offs may reflect concerns about short-term price movements or broader market uncertainty.

Ethereum flow shows dominance of sellers

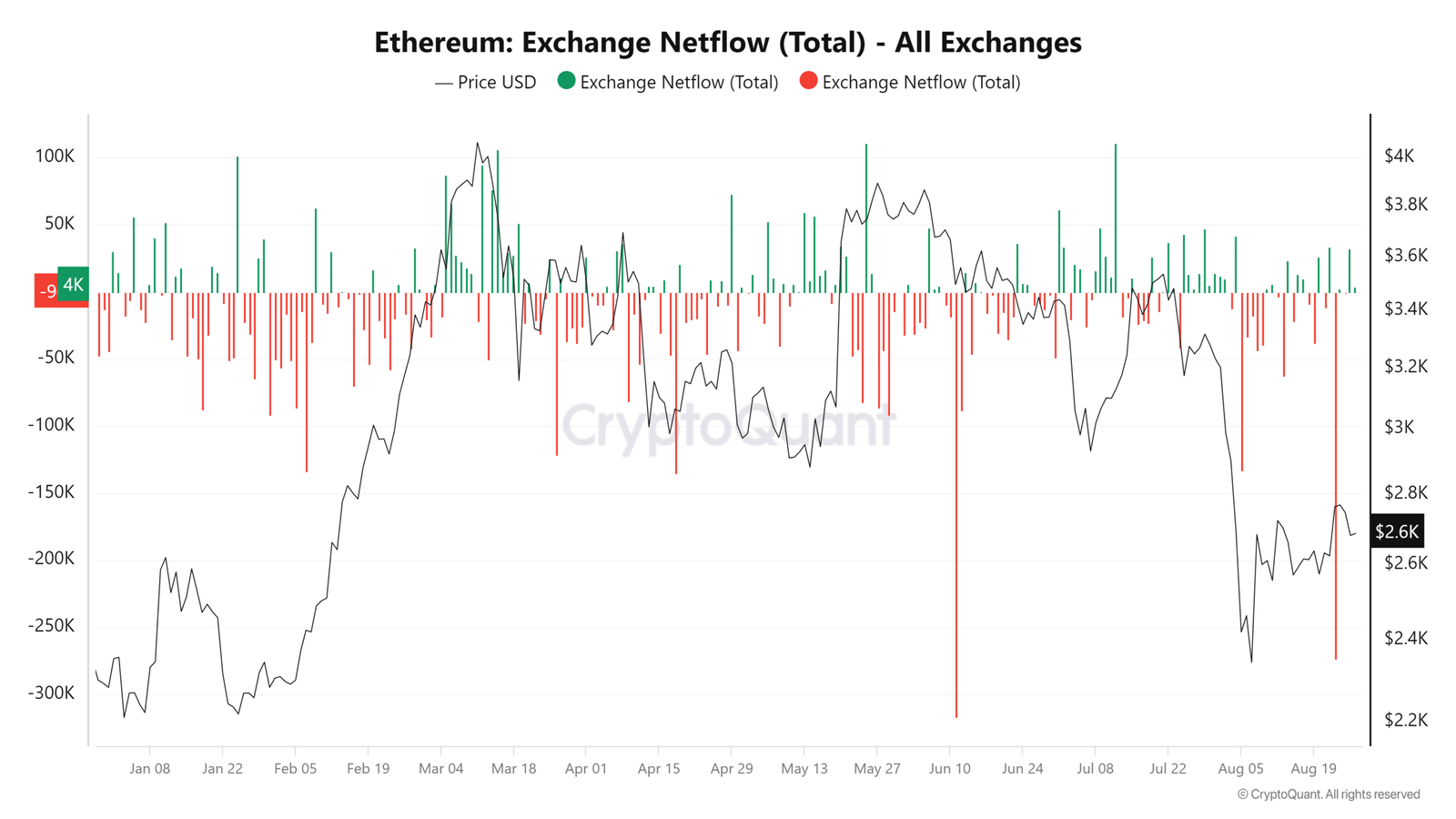

AMBCrypto’s analysis of Ethereum exchange net flow data from CryptoQuant on August 26 revealed a positive net flow.

This indicated that more ETH was deposited into exchanges than was withdrawn that day. Specifically, the net flow was over 32,000 ETH, suggesting that the amount of sell-offs exceeded accumulation during this period.

Source: CryptoQuant

A positive net flow typically signals that investors are moving ETH to exchanges, possibly to sell or trade, which can create short-term selling pressure.

This was consistent with recent data showing that some institutions, such as Amber Group and Cumberland, have sold significant amounts of ETH.

Despite this temporary increase in exchange inflows, however, the broader trend of the past few weeks has seen more outflows of ETH overall.

This means that over a longer time scale, more ETH has been withdrawn from exchanges than deposited, often interpreted as a bullish indicator.

ETH’s exchange flight

The ongoing decline in Ethereum balance on exchanges is a significant trend indicating that more investors are withdrawing their holdings from exchanges.

This reduction in the currency balance suggested that investors may be moving their ETH into cold storage, staking, or other forms of long-term holding instead of keeping it readily available for trading.

Source: Glass node

A declining exchange balance can lead to scarcity of the available supply of ETH on exchanges, which typically has a bullish effect on the value of the asset.

When fewer coins are available for trading and if demand remains strong or increases, scarcity can drive up prices due to the basic economic principle of supply and demand.

This declining currency balance adds to the list of bullish indicators for Ethereum despite the mixed signals observed in recent weeks.

ETH continues to develop weakly

According to AMBCrypto’s analysis, Ethereum has recently struggled to maintain positive momentum.

Its daily price trend analysis reveals that Ethereum has seen consecutive declines over the past three days. At the time of writing, Ethereum was trading at approximately $2,656, reflecting a further decline of nearly 1%.

Source: TradingView

Its short-term moving average (yellow line) continued to act as a significant resistance level around $2,900.

Read Ethereum’s [ETH] Price prediction 2024-25

This resistance has repeatedly prevented Ethereum from breaking higher, contributing to the recent downward pressure on the price.

The continued price decline underscores the mixed signals that have characterized Ethereum’s market activity in recent weeks, with short-term bearish trends contrasting with some longer-term bullish indicators, such as declining currency balances.